The Nagasa Prospect is one of the priority targets developed from the regional BLEG (Bulk Leach Extractable Gold) stream sediment and airborne geophysical surveys, and is located on the southern limb of a regional structure called the Imva Fold (Figure 1). Nagasa is underlain by a sequence of chlorite schists with several bands of steeply-dipping banded ironstone formation (BIF). Artisanal workings are common, the miners mainly exploiting auriferous colluvium below a barren cover of transported soil. These workings indicate potential exists for mineralization over a strike of 3 -- 4 km.

As announced previously in the Company's press release of April 23, 2013, Induced Polarization (IP) geophysical surveys were conducted over an initial 2 km x 2 km block at Nagasa, and three well-defined anomalies were delineated. Additional IP surveys were subsequently carried out to the east and west to determine the strike potential of the anomalies. The southernmost Anomaly (Anomaly 1) has a strike length of at least 6 km, and is associated with the zone of colluvial workings mentioned above, and with localized remnants of colonial mining activity. Pole-Dipole IP arrays were also undertaken to produce pseudo cross sections which indicated that the higher chargeability anomalies were located at depth. Anomalous rock chips samples are also present (Figure 2). Two diamond drill holes, with a strike separation of 2,800 metres, were drilled to test Anomaly 1. IP Anomaly 2 was defined over a 2.9 km strike and located 500 metres north of, and parallel to Anomaly 1. Two wide spaced holes, 500 metres apart, were drilled into Anomaly 2. Again the higher chargeability anomalies from the Pole-Dipole sections appeared to prominent at depth and did not come to surface. One core hole was also drilled into the delineated 1.6 km IP Anomaly 3, which is located about 1 km north of Anomaly 2, and occurs on a topographic high associated with the main BIF unit. Four other shallower diamond drill holes have also been completed by the Company at Nagasa.

Details of the 9 drill holes completed at Nagasa to date are shown in Table 1. The most significant intersections are in NNDD002, NNDD004 and NNDD007, which were all drilled on Anomaly 1. The values occur within a zone of hydrothermal alteration (dolomite + silica +/- chlorite + pyrite +/- pyrrhotite) in the vicinity of BIF unit 4 (Figure 2). Although the IP data indicates that the Anomaly 1 alteration package has a strike of over 6 km, it appears that the gold mineralization indicated by the artisanal/colonial workings, rock chip sampling data and drilling, is irregularly distributed and possibly occurs as plunging shoots. Further closer spaced drilling is required to delineate areas within the altered package with potentially economic gold grades and widths.

Table 1. Nagasa Drilling Results

| Hole | Northing

UTM | Easting

UTM | Azimuth

(degree) | Inclination

(degree) | Depth

(m) | Mineralization | |||

|---|---|---|---|---|---|---|---|---|---|

| From (m) | To (m) | Width (m) | Au (g/t) | ||||||

| 21.54 | 22.52 | 0.98 | 1.12 | ||||||

| 52.10 | 53.10 | 1.00 | 0.85 | ||||||

| NNDD001 | 199640 | 547200 | 360 | -50 | 176.05 | 160.49 | 161.43 | 0.94 | 1.87 |

| NNDD002 | 199724 | 547200 | 360 | -50 | 199.15 | 133.00 | 135.00 | 2.00 | 2.22 |

| NNDD003 | 199926 | 547200 | 360 | -50 | 170.45 | 84.53 | 86.29 | 1.76 | 1.95 |

| 72.14 | 72.90 | 0.76 | 9.03 | ||||||

| NNDD004 | 199811 | 547203 | 360 | -50 | 165.30 | 75.85 | 79.57 | 3.72 | 3.17 |

| NNDD005 | 200190 | 546700 | 360 | -50 | 455.75 | No significant intersection | |||

| NNDD006 | 200225 | 547200 | 360 | -50 | 407.05 | No significant intersection | |||

| 29.46 | 30.75 | 1.29 | 0.80 | ||||||

| NNDD007 | 199710 | 544815 | 360 | -50 | 332.15 | 129.91 | 130.32 | 0.41 | 27.4 |

| NNDD008 | 199455 | 547700 | 360 | -50 | 415.60 | No significant intersection | |||

| NNDD009 | 201400 | 546200 | 360 | -50 | 299.15 | No significant intersection | |||

Drill hole assays are uncut. True thicknesses are estimated to be approximately 87% of intersected drill widths.

The Mondarabe Prospect is situated on the Imva Fold, to the west of Nagasa (Figure 1), and was identified as a high priority target by the regional BLEG survey. Soil and rock chip sampling delineated two anomalous areas, as described in the Company's press release of June 14, 2012 and shown in Figure 3.

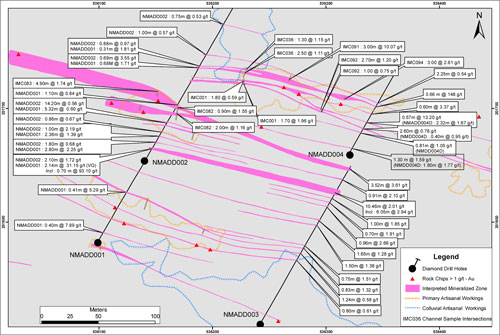

Five diamond drill holes have been completed on the northern anomaly where gold mineralization is associated mainly with foliation-parallel quartz veins and veinlets within a series of metapelites, intruded by sills of dolerite and minor quartz porphyry. Shearing has preferentially affected the dolerite, and hydrothermal fluids have mineralized the shear zones to varying degrees. The most significant mineralized intersections are shown in Table 2 and in Figure 4 and included 10.46 metres grading 2.01 g/t Au, 2.14 metres grading 31.1 g/t Au and 0.66 metres grading 148 g/t Au.

Two drill holes were completed on the southern soil anomaly, which is associated with folded BIF (Figure 3). Both holes intersected significant widths of BIF, with individual units of up to 96 metres, interbedded with sericite schist. The BIF is locally quartz-veined and pyritized, the sulphide occurring as disseminated crystals, massive bands and patches. Despite the fairly widespread hydrothermal alteration, the mineralized zones are relatively narrow, the best intersections in holes 6 and 7 being 3.23 metres grading 3.78 g/t Au and 1.23 metres @ 9.46 g/t Au respectively.

Table 2. Mondarabe Drilling Results

>| Hole | Northing

UTM | Easting

UTM | Azimuth

(degree) | Inclination

(degree) | Depth

(m) | Mineralization | |||

|---|---|---|---|---|---|---|---|---|---|

| From (m) | To (m) | Width (m) | Au (g/t) | ||||||

| 123.90 | 126.04 | 2.14 | 31.15 | ||||||

| Includes: | 0.70 | 93.1 | |||||||

| 134.91 | 137.71 | 2.80 | 2.25 | ||||||

| 150.64 | 153.00 | 2.36 | 1.39 | ||||||

| NMADD001 | 201582 | 536099 | 030 | -50 | 221.05 | 162.82 | 168.14 | 5.32 | 0.60 |

| 18.00 | 21.10 | 2.10 | 1.72 | ||||||

| 35.40 | 36.40 | 1.00 | 2.19 | ||||||

| NMADD002 | 201654 | 536140 | 030 | -50 | 179.75 | 52.80 | 67.00 | 14.20 | 0.56 |

| 131.40 | 132.90 | 1.50 | 1.38 | ||||||

| 138.35 | 140.00 | 1.65 | 1.28 | ||||||

| 152.44 | 153.40 | 0.96 | 2.66 | ||||||

| 162.80 | 163.80 | 1.00 | 1.85 | ||||||

| 166.66 | 177.12 | 10.46 | 2.01 | ||||||

| 187.75 | 188.66 | 0.91 | 2.10 | ||||||

| NMADD003 | 201510 | 536242 | 030 | -50 | 203.00 | 198.48 | 202.00 | 3.52 | 3.61 |

| 5.90 | 7.20 | 1.30 | 1.59 | ||||||

| 46.70 | 47.27 | 0.57 | 13.20 | ||||||

| 58.80 | 59.40 | 0.60 | 3.37 | ||||||

| NMADD004 | 201660 | 536321 | 030 | -50 | 118.35 | 71.60 | 72.26 | 0.66 | 148.0 |

| NMADD005 | 201646 | 536622 | 030 | -50 | 164.05 | 86.48 | 87.13 | 0.65 | 0.91 |

| 116.55 | 118.51 | 1.96 | 2.23 | ||||||

| 158.43 | 159.47 | 1.04 | 3.10 | ||||||

| 186.58 | 189.81 | 3.23 | 3.78 | ||||||

| 224.30 | 227.95 | 3.65 | 1.29 | ||||||

| NMADD006 | 199980 | 535840 | 360 | -50 | 236.65 | 230.97 | 232.07 | 1.10 | 2.22 |

| NMADD007 | 200055 | 536160 | 360 | -50 | 97.65 | 92.00 | 93.23 | 1.23 | 9.46 |

Drill hole assays are uncut. True thicknesses are estimated to be approximately 76% of intersected drill widths.

IP surveys are currently in progress at the Matete and Anguluku prospects (Figure 1) where the surface expression of mineralization may be masked by the presence of transported overburden. Both prospects were identified as high priority BLEG targets, and the airborne magnetic data indicates that the areas currently being covered by IP are underlain by structurally favourable (folded and faulted) BIF. At both prospects, 4 sq km will initially be covered by gradient array IP, followed by selected lines of pole-dipole to provide sectional data for drill targeting.

In terms of the Makapela P.E.A. (Preliminary Economic Assessment), due to the sharply lower gold price, it has been decided not to incur any further expenditure on the study until the gold market improves.

"Much more drilling and further groundwork is required to adequately test our targets on our large landholdings at Ngayu," commented Loncor's President and CEO, Peter Cowley. "However, the recent sharp decrease in the gold price and its marked affect, especially on the junior gold exploration sector, has necessitated that we reduce our exploration effort and overhead costs until market conditions improve."

Drill cores for assaying were taken at a maximum of one metre intervals and were cut with a diamond saw with one-half of the core placed in sealed bags by Company geologists and sent to the SGS Laboratory (which is independent of the Company) in Mwanza, Tanzania. The core samples were then crushed down to minus 2 mm, and split with one half of the sample pulverized down to 90% passing 75 microns. Gold analyses were carried out on 50g aliquots by fire assay. Internationally recognized standards and blanks were inserted as part of the Company's internal QA/QC analytical procedures.

Qualified Person

The exploration results disclosed in this press release have been reviewed, verified (including sampling, analytical and test data) and compiled by the Company's geological staff based in Beni, DRC, under the supervision of Dr. Howard Fall (Aus.I.M.M), the Company's Exploration Manager and a "qualified person" (as such term is defined in National Instrument 43-101).

Technical Report

Additional information with respect to the Company's Ngayu Gold Project is contained in the technical report prepared by Venmyn Rand (Pty) Ltd, dated May 29, 2012 and entitled "Updated National Instrument 43-101 Independent Technical Report on the Ngayu Gold Project, Orientale Province, Democratic Republic of the Congo". A copy of this report can be obtained from SEDAR at www.sedar.com and EDGAR at www.sec.gov.

Loncor Resources Inc. is a Canadian gold exploration company focused on two projects in the Democratic Republic of the Congo ("DRC") -- the Ngayu and North Kivu projects. The Company has exclusive gold rights to an area covering 2,087 sq km of the Ngayu Archaean greenstone belt in Orientale province in the northeast DRC. Loncor also owns or controls 53 exploration permits in North Kivu province located west of the city of Butembo. Both areas have historic gold production. Led by a team of senior exploration professionals with extensive African experience, Loncor's strategy includes an aggressive drilling program to follow up on initial known targets as well as covering the entire greenstone belt with regional geochemical and geophysical surveys. Additional information with respect to the Company's projects can be found on the Company's web site at www.loncor.com.

Cautionary Note to U.S. Investors

The United States Securities and Exchange Commission (the "SEC") permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. Certain terms are used by the Company, such as "Indicated" and "Inferred" "Resources", that the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC. U.S. Investors are urged to consider closely the disclosure in the Company's Form 40-F Registration Statement, File No. 001-35124, which may be secured from the Company, or from the SEC's website at http://www.sec.gov/edgar.shtml.

Cautionary Note Concerning Forward-Looking Information

This press release contains forward-looking information. All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding drilling and other exploration results, mineral resources and potential mineral resources, potential mineralization and the Company's exploration and development plans) are forward-looking information. This forward-looking information reflects the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking information is subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking information, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things, risks related to the exploration stage of the Company's properties, the possibility that future exploration or development results will not be consistent with the Company's expectations, failure to establish estimated mineral resources (the Company's mineral resource figures are estimates and no assurance can be given that the indicated levels of gold will be produced), changes in world gold markets or equity markets, political developments in the DRC, uncertainties relating to the availability and costs of financing needed in the future, gold recoveries being less than those indicated by the metallurgical testwork carried out to date (there can be no assurance that gold recoveries in small scale laboratory tests will be duplicated in large tests under on-site conditions or during production), the uncertainties involved in interpreting drilling results and other geological data and the other risks disclosed under the heading "Risk Factors" and elsewhere in the Company's annual report on Form 20-F dated March 28, 2013 filed on SEDAR at www.sedar.com and EDGAR at www.sec.gov. Forward-looking information speaks only as of the date on which it is provided and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

For further information, please visit our website at www.loncor.com or contact: Peter N. Cowley, President and Chief Executive Officer, Telephone: + 44 (0) 790 454 0856; or Arnold T. Kondrat, Executive Vice President, or Naomi Nemeth, Investor Relations, Telephone: (416) 366-9189 or 1 (800) 714-7938.

Figure 1 -- Location of the main gold prospects in the Ngayu Concession

Figure 2 --Nagasa Prospect -- magnetics, IP anomalies and location of drill holes.

Figure 3 -- Mondarabe Prospect -- magnetics, soil geochemistry and location of drill holes

Figure 4 -- Mondarabe Prospect, Northern Anomaly, interpretation of drilling and channel sampling intersections

![Loncor Resources Inc. [logo]](/templates/loncor/images/logo-loncor.svg)